Friday, 13 March 2026

India’s maize exports have remained inconsistent over the years, fluctuating in between 4.75 million MT in 2013 to 2.31 million MT in 2023 due to changing production patterns and high domestic prices.

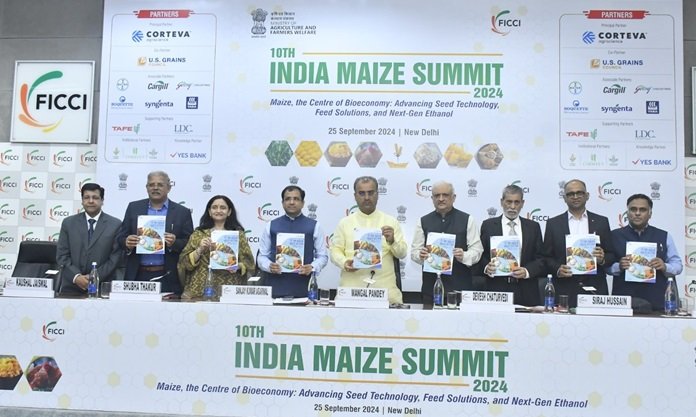

FICCI organised the 10th edition of ‘India Maize Summit 2024’, highlighting the role of maize in food, feed and industrial uses. Kaushal Jaiswal, Co-Chairman, FICCI National Agriculture Committee and Managing Director, Rivulis Irrigation India Pvt. Ltd. mentioned that Maize Summit is an effort to bring fore the global and domestic scenario of maize and issues confronting the maize supply chain.

FICCI-YES BANK knowledge report – ‘The Indian Maize Sector – Trends, Challenges & Imperatives for Sustainable Growth’, was released during the session.

Sunjay Vuppuluri, National Head-Food & Agribusiness Strategic Advisory & Research, YES BANK shared the insights on FICCI-YES BANK knowledge report.

Key highlights of the report:

The Indian Maize Sector – Trends, Challenges & Imperatives for Sustainable Growth

Maize is a multifaceted crop with a wide range of uses, including for food, feed, industrial applications, energy, and pharmaceuticals. As a food source, maize is consumed in various forms such as cornmeal, flour, and sweet corn. In addition to its food value, maize is an essential ingredient in animal feed, particularly for poultry and livestock. Its industrial applications are diverse, with maize starch, oil and other derivatives used in the production of food, biodegradable plastics, textiles, paper, and pharmaceuticals. Maize is also used to produce ethanol, a biofuel that is blended with petrol.

In 2022, about 1.17 billion metric tons (MT) of maize was produced, which was 30.9 per cent higher than that of wheat (0.81 billion MT) and 33.8% higher than that of rice (0.78 billion MT). Global maize production has increased from 0.89 billion MT in 2012 to 1.17 billion MT in 2022, growing at a decadal CAGR of 2.9 per cent.

In 2022, USA was the largest producer of maize contributing about 30% of global production followed by China (24 per cent) and Brazil (9 per cent).

Global consumption of maize has grown at a CAGR of 2.3% over a period of 10 years increasing from 988.6 million MT in 2013 to 1236.8 million MT in 2023.

Global exports grew at a decadal CAGR (2013-2023) of 5.1%, increasing from 122.8 million MT in 2013 to 202.1 million MT in 2023.

In 2023, maize prices reached their lowest values since 2021 at USD 223 per MT. Ample supplies from Brazil and competition among exporters underpinned the downward trend.

In 2022, India ranked 4th in global maize acreage and 5th in global production contributing to about 4.9% of acreage and 2.9% of production respectively.

In India, about 22 per cent of maize is consumed directly as food while a major share of production is consumed for industrial usage mainly for animal feed and starch.

Maize productivity in India has increased from 2.6 MT/Ha to 3.5 MT/Ha growing at a decadal CAGR of 3.3 per cent (2012-13 to 2022-23).

Maize is principally grown in two seasons: kharif (75% area) and rabi (20 per cent area), with the average productivity of kharif maize being 2.94 MT/ha and rabi maize 5.36 MT/ha.

India’s maize exports have remained inconsistent over the years, fluctuating in between 4.75 million MT in 2013 to 2.31 million MT in 2023 due to changing production patterns and high domestic prices.

India imported USD 8.0 million worth of maize in 2023, primarily from South Africa (74%), the United States (15 per cent), and Argentina (6%).

The key factors driving the growth of the maize ecosystem include increasing demand from the poultry and livestock sectors as well as growing industrial uses such as ethanol production.

Challenges at the farm level include low adoption of hybrid seeds, with only about 30% of the cultivated area under Single Cross hybrids.

Post-harvest handling challenges include poor quality management, leading to moisture content as high as 18 per cent, making the produce susceptible to fungal infection and high aflatoxin levels.

Challenges in the maize processing industry include high raw material costs due to price fluctuations, varietal and quality mismatches, and restrictions on maize imports due to GM regulations.

Key imperatives for sustaining growth of maize sector identified in the report are listed below