Samunnati plans robust pipeline of over Rs 600 Cr for Q1 FY26, strengthening its position in agri-ecosystem

Company has demonstrated financial resilience by maintaining an average monthly liquidity level of Rs 142 crore, a 65 per cent increase over the previous year.

Samunnati, India’s pioneering agri-value chain enabler, has successfully raised Rs 2,300 crore in debt funding during FY25, marking a 50 per cent increase over the previous year. Looking ahead, Samunnati has a robust pipeline of over Rs 600 crore for Q1 FY26, positioning the company for continued expansion and financial innovation in the agri-sector. This significant growth in numbers reflects Samunnati’s strong financial standing and its continued commitment to enabling financial access for smallholder farmers and agri-enterprises.

It has diversified its sources of lending, leveraging debt market instruments, securitisation, and increased bank exposure, which has enabled it to onboard 12 new prominent lenders, bringing the total lender relationships to 46.

Notable additions include banking institutions such as State Bank of India (SBI), Indian Overseas Bank (IOB), Federal Bank, Kotak Mahindra Bank, Karur Vysya Bank (KVB), and ESAF Small Finance Bank. Additionally, key Developmental Financial Institutions (DFIs) like Blue Earth, USDFC, and Enabling Qapital, along with major Non-Banking Financial Companies (NBFCs) including Piramal, Shriram Finance, and Ambit, have partnered with Samunnati. This financial strength has enabled it to deliver over Rs 7,000 crores in Gross Transaction Value (GTV) and achieve a growth of 30 per cent average Assets Under Management (AUM), reaching Rs 2,000 crore.

Samunnati’s innovative solutions extend beyond capital access, providing tailored financial solutions that strengthen access to markets, improve supply chain efficiency, and drive sustainability across agricultural value chains.

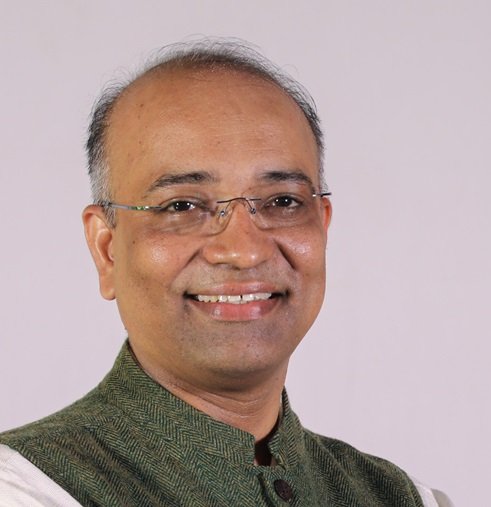

Anil Kumar SG, Founder, Samunnati said, “Samunnati remains committed to enabling agri value chains and its players with customised solutions that empower the value chain players and promote impact driven growth in the agriculture sector. Our ability to raise capital efficiently, even in a challenging liquidity environment, is a testament to the trust our lending partners have placed in us. As we continue to scale, our focus remains on empowering smallholder farmers, farmer collectives and agri-enterprises with innovative solutions.”

Amidst a tight liquidity environment, Samunnati has demonstrated financial resilience by maintaining an average monthly liquidity level of Rs 142 crore, a 65 per cent increase over the previous year.

During FY25, Samunnati has reached an important milestone by becoming the first NBFC in the agriculture sector to list a Green Bond on the Bombay Stock Exchange (BSE), in compliance with revised guidelines and backed by a third-party-certified Sustainable Finance Framework. This milestone underscores Samunnati’s commitment to sustainable finance and impact-driven growth.

With its growing financial strength, expanding lender network, and a steadfast commitment to empowering agri-value chains, Samunnati continues to shape the future of India’s agricultural ecosystem.

Company has demonstrated financial resilience by maintaining